The fluctuations in the price of bitcoin attract traders of all experience levels. Comprehending the chart analysis conducted by cryptocurrency specialists such as Didi Taihuttu may provide significant understanding of possible price trends.

We'll go into the most recent Bitcoin chart analysis in this blog, looking at both the present patterns and possible future moves.

Current Movement in the Price of Bitcoin

Temporal Analysis

Latest Rebound

Bitcoin dropped yesterday, but it later rose to almost $61,000. Traders that profited from this decline may have made about $3,000. Significant support levels served as the foundation for the trade advice, suggesting that there may be an upward advance from these levels.

Setup for Short-Term Trade

The price closed below the stepping line, indicating a short-sell opportunity; technical signs included the blue line crossing below the white line and a red and yellow signal preponderance. The significant wicks where the blue line crossed the red line were potential profit areas.

Analysis of Daily Charts

200-Day Moving Mean:

In the past, the 200-day moving average (MA) has been a crucial support level during bull markets. The current price of bitcoin nearly reached this MA, which has served as a reliable support line. This average is frequently respected by price activity, indicating a possible turning point.

Index of Relative Strength (RSI)

The daily chart's RSI is noticeably low, hovering around the 20 level, which has traditionally been a reliable predictor of an impending price spike. About 10 times since 2016, Bitcoin has reached this level, each time being followed by a significant price gain.

Context of RSI Levels in History

Examining past RSI falls to the 20 level identifies recurring trends of notable market rallies:

2017 Bull Market: Following an RSI drop below 20, Bitcoin shot up to $70,000.

2020 Market Recovery: After a comparable RSI fall, prices surged from $7,000 to $24,000.

earlier Examples: Price hikes followed comparable patterns in 2018, 2016, and earlier years, demonstrating the predictive value of low RSI levels.

Extended Bitcoin Analysis

Cycles of Four Years

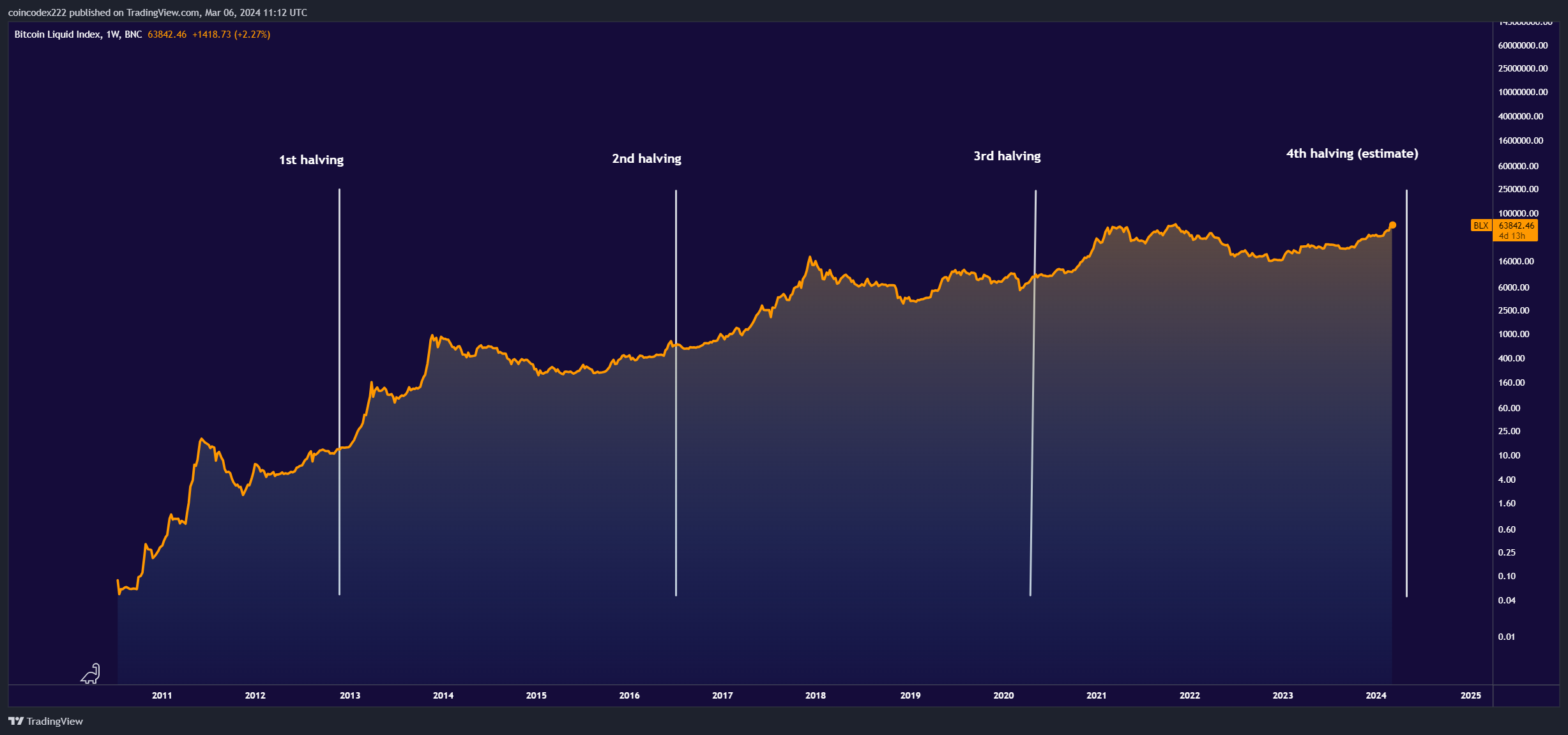

The price swings of Bitcoin often correspond with a four-year cycle, which is triggered by halving occurrences. Significant price maxima have been observed in the past, around 17 months after the halving:

2017 Peak: The cryptocurrency reached its zenith 17 months after its halving.

2021 Peak: 17 months after the halving, there was another peak.

Next Prediction: If this trend continues, the next high is expected in August or September of 2025.

Insights from Monthly Charts

The monthly chart, which demonstrates a unique pattern of bottoming out before soaring to new highs, lends credence to the four-year cycle idea. The significance of long-term holding is underscored by this cyclical pattern, which points to a possible price high in the upcoming years.

Read Also: Get Started with Blockchain Technology

Following-Halving Price Changes

Sideways Motion

In the past, after a halving, the price of Bitcoin has often moved sideways for about 150 days before starting to rise significantly. In the bull markets of 2012, 2016, and 2020, this pattern was noted.

Prospects for the Future

Considering past post-halving tendencies

In the short run, sideways movement is likely to occur within a range, maybe between $60,000 and $70,000.

Long-term: During the following five months, a significant price increase is probably in store, with possible objectives falling between $120,000 and $140,000.

In summary

Based on the historical patterns and present price behavior of bitcoin, it appears that a large price shift is imminent. Bitcoin looks ready for an upswing, with the RSI at historically low levels and firm support centered around the 200-day moving average. Comprehending these patterns and their historical backgrounds may offer significant perspectives for crafting well-informed investing choices. Important buying chances before the next big price surge might come in the following several months.

Financial Intelligence

Investing in Bitcoin strategically might pay out handsomely in these potentially crucial months. Historical data shows that significant price gains frequently occur before times of low RSI and strong support levels. Thus, the current state of the market makes investing very attractive and supports the proverb "When there's blood in the streets, buy Bitcoin."